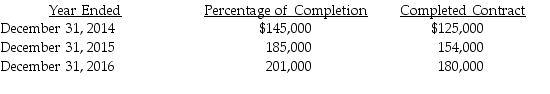

Hampton's Construction,Inc.decided to change from completed-contract method of accounting to percentage-of-completion method.Hampton will continue to us the completed-contract method for income tax purposes.The following information is available for net income.The income tax rate for all years is 35%.

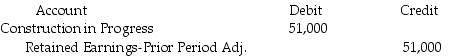

What is the journal entry to record the change in accounting principle on January 1,2016?

What is the journal entry to record the change in accounting principle on January 1,2016?

A) No journal entry need for prospective application of the change in principle.

B)

C)  Construction in Progress 72,000

Construction in Progress 72,000

D)  Retained Earnings-Prior Period Adj. 33,150

Retained Earnings-Prior Period Adj. 33,150

Correct Answer:

Verified

Q23: Journal entry for the year of the

Q25: Anzelmo Corporation invested in Jones Manufacturing by

Q26: Anzelmo Corporation invested in Jones Manufacturing by

Q29: When a company makes a change in

Q29: Butler Products decided in 2016 to change

Q30: Bronco Construction,Inc.decided to change from completed-contract method

Q31: Energy,Inc began operations in 2015 using LIFO

Q32: Hampton's Construction,Inc.decided to change from completed-contract method

Q33: Prepare the footnote disclosure for the change

Q36: Which one of the following would not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents