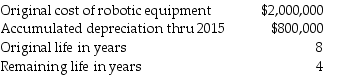

Jenkins,Inc.builds custom machines for manufacturers using robotic equipment.In 2016,the company decided to change from straight-line to double-declining-balance depreciation for its robotic equipment.It changed the life expectancy as follows:

Determine the correct amount of depreciation to expense for 2016.

Determine the correct amount of depreciation to expense for 2016.

A)$250,000

B)$300,000

C)$400,000

D)$600,000

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Georgio, Inc. decided to move its business

Q57: Changes in methods of depreciation are changes

Q59: For which one of the following changes

Q60: Disclosures are required for all accounting estimates

Q61: When a large corporation purchases a new

Q63: In reconciling information to complete its financial

Q64: John Pickens writes mystery novels.His publisher pays

Q65: Emma's Clothes,Inc.has accounts receivable of $210,000.In the

Q66: The auditor for Universal Tools,Inc.discovered in 2017

Q67: Brown Furniture Company decided to go after

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents