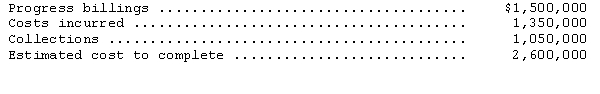

F & R Construction,Inc.has consistently used the percentage-of-completion method of recognizing revenue.Last year F & R started work on a $5,000,000 construction contract,which was completed this year.The accounting records disclosed the following data for last year:

How much revenue should F & R have recognized on this contract last year?

A) $1,500,000

B) $1,700,000

C) $1,100,000

D) $400,000

Correct Answer:

Verified

Q1: Builder Construction Company's projects extend over several

Q2: If a company uses the completed-contract method

Q3: Which of the following is NOT an

Q10: Which of the following is NOT a

Q18: Which of the following would be used

Q23: Chantal Company began operations on January 2,2014,and

Q25: Astor Construction Company uses the percentage-of-completion method

Q26: Steinman Construction Company uses the percentage-of-completion method

Q35: Franchise fees are properly recognized as revenue

A)

Q38: In accounting for sales on consignment,sales revenue

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents