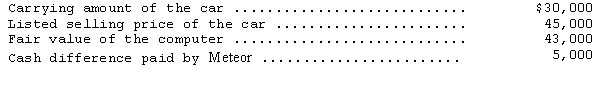

Meteor Motor Sales exchanged a car from its inventory for a computer to be used as a noncurrent operating asset.The following information relates to this exchange that took place on July 31,2014:

The exchange has commercial substance.

On July 31,2014,how much profit should Meteor recognize on this exchange?

A) $0

B) $8,000

C) $10,000

D) $13,000

Correct Answer:

Verified

Q28: Mantle Company exchanged a used autograph-signing machine

Q29: Underwood Company purchased a machine on January

Q30: Stanley Company purchased a machine that was

Q32: Stiller Company owns a machine that was

Q33: Lex Soaps purchased a machine on January

Q34: On January 1,2014,Ashton Company purchased equipment at

Q37: When assets are exchanged at a loss

Q38: The Bromley Company purchased a tooling machine

Q39: In recording the trade of one asset

Q40: On December 2,2014,Loofa Company,which operates a furniture

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents