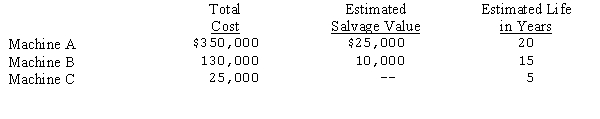

At the start of its business,Londres Corp.decided to use the composite method of depreciation and prepared the following schedule of machinery owned.

Londres computes depreciation on the straight-line method.Based on the information presented,the composite life of these assets (in years) should be

A) 13.4

B) 14.4

C) 15.9

D) 17.1

Correct Answer:

Verified

Q43: Cavallo Company acquired a tract of land

Q44: Lovejoy Co.purchased a patent on January 1,2011,for

Q44: A company owns a piece of land

Q46: Ibarra Carpet traded cleaning equipment with a

Q47: A truck that cost $12,000 was originally

Q49: In January 2014,Router Mining Corporation purchased a

Q54: On January 1,2013,Canal Locks Corporation purchased drilling

Q55: Backhoe Construction Company recently exchanged an old

Q57: On January 1,2010,Elaine Company purchased for $600,000,a

Q58: During 2009,Cabot Machine Company spent $352,000 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents