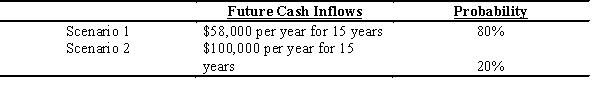

Python Mining Company has a copper mine in Nevada operating at a reduced level of production for the past two years.The market for copper has been adversely affected by weak prices,low demand,and foreign competition.Management believes that the market likely will improve next year and does not plan to abandon this facility.Nevertheless,the controller of the company plans to test the plant and equipment of the operation for impairment due to the decrease in its use.The plant and equipment used in this operation were acquired five years ago for $1,600,000 and have been depreciated using straight-line depreciation over a 20-year life with no residual value.The controller estimates that the assets have a remaining useful life of 15 years and that the following two cash flow scenarios are possible,with the indicated probabilities:

The fair value of the plant and equipment is estimated to be $890,000.

Prepare the entry (if any)required to recognize the impairment loss.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Which of the following assets generally is

Q75: The impairment test for an intangible asset

Q76: The following is a schedule of machinery

Q77: A recently issued FASB standard requires that

Q77: Information concerning Santori Corporation's intangible assets is

Q78: Algon Company owns a machine that cost

Q81: Image Creators,Inc.owns the following equipment and computes

Q82: The 2014 annual report of Fracking,Inc.,provides the

Q83: Wastenot is a waste disposal company.Explain the

Q84: Roadworthy Company acquired Highway Company on January

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents