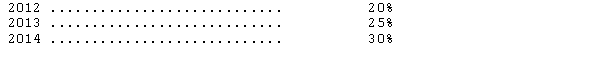

For three consecutive years,2012-2014,Siamese Corporation has reported income before taxes of $200,000 for both financial reporting purposes and tax reporting purposes.During this time,Siamese income tax rates were as follows:

In 2015,Siamese' tax rate changed to 35 percent.Also in 2015,the company reported a loss for both financial reporting and tax reporting purposes of $200,000.Assuming the company uses the carryback provisions,the amount Siamese' should report as an income tax refund receivable in 2015 is

A) $45,000.

B) $50,000.

C) $60,000.

D) $67,500.

Correct Answer:

Verified

Q14: A company would most likely choose the

Q21: Ballantine Products,Inc.,reported an excess of warranty expense

Q22: Analysis of the assets and liabilities of

Q24: A deferred tax liability arising from the

Q26: Longhorn Corporation reported a loss for both

Q27: On the statement of cash flows using

Q33: If all temporary differences entering into the

Q37: Amengual Corporation began operations in 2011 and

Q38: On December 31,2013,Breezeway,Inc. ,reported a current deferred

Q40: The asset-liability method of interperiod tax allocation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents