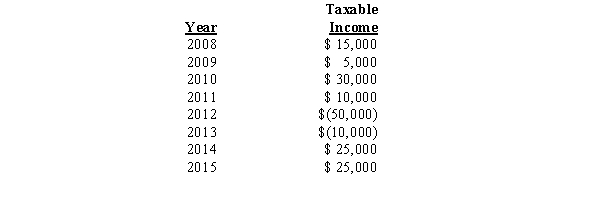

The data shown below represent the complete taxable income history for Confederacy Corporation.The tax rate was 35% throughout the entire period 2008 through 2015:

If the company always chooses the carryback,carryforward option,what is the tax liability for 2014?

A) $1,750

B) $8,750

C) $5,250

D) $0

Correct Answer:

Verified

Q62: Pretax accounting income is $100,000 and the

Q68: Smart Services computed pretax financial income of

Q69: A major conceptual issue associated with interperiod

Q70: The accounting profession has wrestled for many

Q71: Myerson Company reported taxable income of $60,000

Q74: A major conceptual issue regarding the accounting

Q75: Oriole Industries computed a pretax financial income

Q76: The following differences between financial and taxable

Q77: Allsgood Appliances computed a pretax financial loss

Q78: Eva Designs,Inc.,a corporation organized on January 1,2005,reported

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents