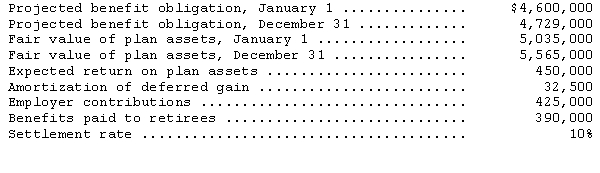

The following information relates to the defined benefit pension plan of the Summersville Company for the year ending December 31,2014:

The net amount of the gain or loss component to be included in pension cost for 2014 would be

A) $8,500

B) $32,500.

C) $47,500.

D) $77,500.

Correct Answer:

Verified

Q14: Which of the following is not a

Q16: Which of the following payroll taxes are

Q21: Which of the following is NOT correct?

A)

Q22: Pandora Company determined that it has an

Q25: Which of the following components should be

Q26: Redman Corporation is a publicly held company

Q34: On January 1,2014,Reds Corporation adopted a defined

Q35: The interest cost component for other postretirement

Q38: Quinn Company has a defined benefit plan.The

Q40: The following information relates to the defined

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents