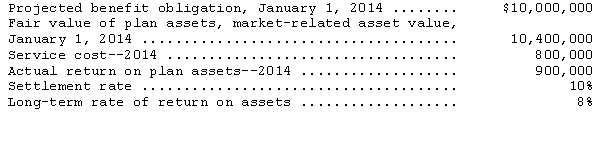

Gordon Inc.has a defined benefit plan for its employees.The following information relates to this plan:

There was no unrecognized prior service cost or unrecognized gains or losses.Gordon's net periodic pension cost for the year was

A) $968,000.

B) $940,000.

C) $900,000.

D) $880,000.

Correct Answer:

Verified

Q21: Which of the following is NOT correct?

A)

Q23: On January 1,2014,Reason Co.estimated a projected benefit

Q26: Redman Corporation is a publicly held company

Q26: Vinny,Inc.has an incentive compensation plan under which

Q27: Which of the following statements is correct?

A)

Q28: International accounting standards for pensions currently in

Q31: Lincoln Corporation provides an incentive compensation plan

Q32: On January 1,2014,Bongle Co.amended its defined benefit

Q35: The interest cost component for other postretirement

Q40: The following information relates to the defined

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents