Lunes Company,a U.S.company,owns a 100% interest in its subsidiary,Placido,S.A.,located in Italy.Placido,S.A.,began operations on January 1,2014.The subsidiary's operations consist of leasing space in an office building.The building,which cost one million euros,was financed primarily by Italian banks.All revenues and expenses are received and paid in euros.The subsidiary also maintains its accounting records in euros.In light of these facts,management of the U.S.parent has determined that the euro is the functional currency of the subsidiary.

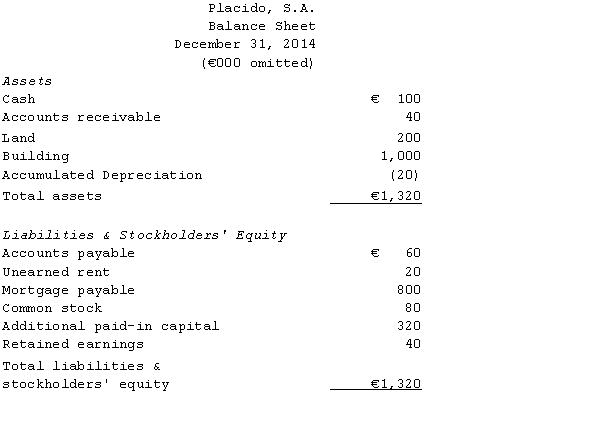

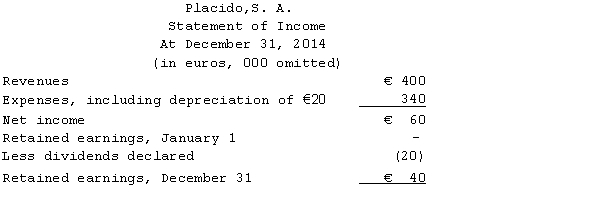

The subsidiary's balance sheet at December 31,2014,and income statement for the year then ended,are presented below,in euros:

The following are relevant exchange rates for the year 2014:

€1 = $1.50 at the beginning of 2014,at which time the common stock

was issued and the land and building were financed by the mortgage.

€1 = $1.55 weighted average for 2014.

€1 = $1.58 at the date the dividends were declared and paid and

the unearned rent was received.

€1 = $1.62 at the end of 2014.

Required:

Prepare in U.S.dollars a balance sheet at December 31,2014,and an income statement for the year then ended.

Correct Answer:

Verified

Q42: Financial information for Pinnacle Enterprises at the

Q43: The following financial information is for Milo

Q44: The following financial information is available for

Q45: On July 15,2014,American Manufacturing Inc.,a Los Angeles

Q45: Under international accounting standards,deferred tax assets and

Q46: Which of the following statements is correct?

A)

Q49: Hibachi,Inc.,purchased Wasabi Manufacturing Company,a Japanese company,on January

Q51: The following financial information is for Pasha

Q53: Which of the following is correct regarding

Q56: Which of the following statements regarding international

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents