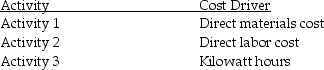

The manufacturing division of an electronics company uses activity-based costing.The company has identified three activities and the related cost drivers for indirect production costs.

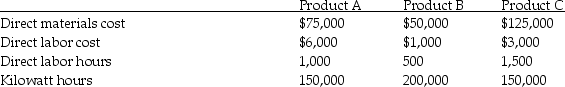

Three types of products are produced.Direct costs and cost-driver activity for each product for a month are as follows:

Three types of products are produced.Direct costs and cost-driver activity for each product for a month are as follows:

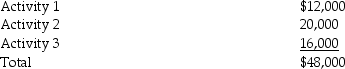

Indirect production costs for the month are as follows:

Indirect production costs for the month are as follows:

Required:

Required:

A)Compute the indirect production costs allocated to each product using the ABC system.

B)Compute the indirect production costs allocated to each product using a traditional costing system.Assume indirect production costs are allocated to each product using the cost driver: direct labor hours.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: _ is the process of comparing products

Q107: In contrast to traditional costing systems,activity-based costing

Q109: Speedy Company has identified the following activities

Q111: Storing inventories and transporting incomplete products in

Q112: A(n)_ is the cost of an activity

Q113: Benchmarking is the continuous process of comparing

Q114: Traditional costing systems generally assign only production

Q114: Yesterday Bank had the following activities,traceable costs,and

Q121: Which of the following is an example

Q135: Value-added costs are not necessary for most

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents