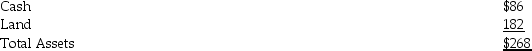

The balance sheet for Lewis Company at January 1,2016 follows:

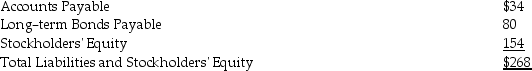

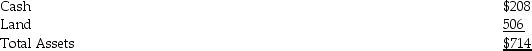

The balance sheet for Martin Company at January 1,2016 follows:

The balance sheet for Martin Company at January 1,2016 follows:

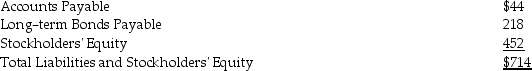

On January 1,2016,Martin Company paid $154 in cash for 100 percent of the outstanding stock of Lewis Company.The fair value of the assets and liabilities of the Lewis Company were equal to their book value.During the year ended December 31,2016,the Lewis Company had net income of $14 and the Martin Company had net income of $50.There were no intercompany sales.All net income for both companies is in the form of cash.

On January 1,2016,Martin Company paid $154 in cash for 100 percent of the outstanding stock of Lewis Company.The fair value of the assets and liabilities of the Lewis Company were equal to their book value.During the year ended December 31,2016,the Lewis Company had net income of $14 and the Martin Company had net income of $50.There were no intercompany sales.All net income for both companies is in the form of cash.

Required:

A)Prepare the consolidated balance sheet immediately after acquisition of stock in Lewis Company.

B)Prepare the consolidated balance sheet at December 31,2016.

Correct Answer:

Verified

Q63: The section of the annual report that

Q70: If the fair value of a subsidiary's

Q75: On January 1,2012,a parent company acquired all

Q76: Goodwill is amortized on the consolidated financial

Q78: Orlando Company acquired all of the shares

Q80: On January 1,2012,a parent company acquired all

Q81: The following information is available for the

Q82: The Baseless Company reports the following information:

Q83: The following information is available for the

Q84: The following information is available for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents