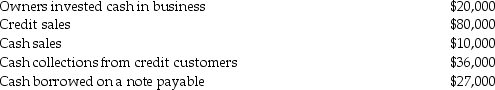

Given below are the activities of the Tucson Company:  Using the accrual basis of accounting,the total revenues for Tucson Company are ________.

Using the accrual basis of accounting,the total revenues for Tucson Company are ________.

A) $46,000

B) $90,000

C) $126,000

D) $173,000

Correct Answer:

Verified

Q64: Implicit transactions are associated with _.

A)cash basis

Q65: Nonprofit organizations do not use balance sheets.

Q68: On May 1,San Jose Company paid $36,000

Q71: Source documents are associated with _.

A) Generally

Q71: The cash basis of accounting does not

Q72: The accrual basis of accounting recognizes the

Q73: Depreciation expense is computed on _.

A)equipment and

Q74: On May 1,San Diego Company paid $36,000

Q76: An example of an implicit transaction is

Q86: Under accrual basis accounting,unexpired costs are considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents