What are the correct monthly rates for calculating failure to file and failure to pay penalties?

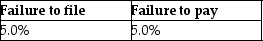

A)

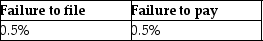

B)

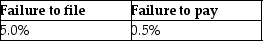

C)

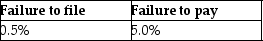

D)

Correct Answer:

Verified

Q21: Larry and Ally are married and file

Q85: Describe the steps in the legislative process

Q86: Mia is self-employed as a consultant.During 2013,Mia

Q97: Chris,a single taxpayer,had the following income and

Q98: Jeffery died in 2013 leaving a $6,000,000

Q2216: During the current tax year, Frank Corporation

Q2220: Doug and Frank form a partnership, D

Q2226: Describe the components of tax practice.

Q2227: Explain how returns are selected for audit.

Q2230: Describe the types of audits that the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents