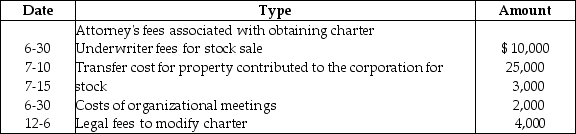

Edison Corporation is organized on July 31.The corporation starts business on August 10.The corporation adopts a November 30 fiscal year end.The following expenses are incurred during the year:  What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending November 30?

What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending November 30?

A) $16,000

B) $12,000

C) $5,156

D) $800

Correct Answer:

Verified

Q2: Identify which of the following statements is

Q32: Identify which of the following statements is

Q33: In 2011,Summer Corporation earns domestic gross receipts

Q34: Organizational expenditures include all of the following

Q35: Green Corporation is incorporated on March 1

Q35: Booth Corporation sells a building classified as

Q39: In February of the current year, Brent

Q41: Island Corporation has the following income and

Q58: West Corporation purchases 50 shares (less than

Q110: Which of the following items is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents