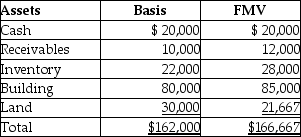

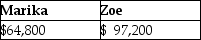

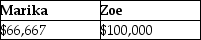

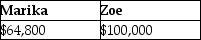

The LM Partnership terminates for tax purposes on July 15 when Latasha sells her 60% capital and profits interest to Zoe for $100,000.The partnership has no liabilities,and its assets at the time of termination are as follows:  Marika,a 40% partner in the LM Partnership,has a $64,800 basis in her partnership interest (outside basis) at the time of the termination.She has held her LM Partnership interest for three years at the time of the termination.The bases of Marika and Zoe in the new LM Partnership is:

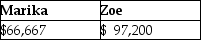

Marika,a 40% partner in the LM Partnership,has a $64,800 basis in her partnership interest (outside basis) at the time of the termination.She has held her LM Partnership interest for three years at the time of the termination.The bases of Marika and Zoe in the new LM Partnership is:

A)

B)

C)

D)

Correct Answer:

Verified

Q27: Two years ago,Tom contributed investment land with

Q32: Last year, Cara contributed investment land with

Q39: Jerry has a $50,000 basis for his

Q60: Adnan had an adjusted basis of $11,000

Q74: The Tandy Partnership owns the following assets

Q85: When must a partnership make mandatory basis

Q89: Patrick purchased a one-third interest in the

Q93: Which of the following is valid reason

Q94: Which of the following statements is correct?

A)A

Q95: Patrick purchases a one-third interest in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents