Beta Corporation incurs an $80,000 regular tax liability and a $20,000 AMT liability.Assuming no restrictions on Beta's ability to use the minimum tax credit,what journal entry would be necessary to record tax expense?

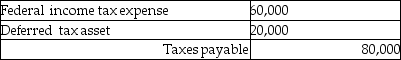

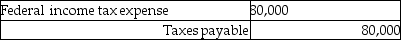

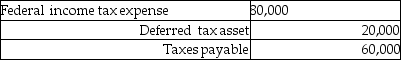

A)

B)

C)

D)

Correct Answer:

Verified

Q7: The NOL deduction is calculated the same

Q10: The personal holding company tax might be

Q21: Mountaineer,Inc.has the following results: Q21: Which of the following statements about the Q22: Tax-exempt interest income on state and local Q24: Identify which of the following statements is Q29: Becky places five-year property in service during Q33: Identify which of the following statements is Q36: How does the deduction for U.S.production activities Q38: Which of the following statements regarding the![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents