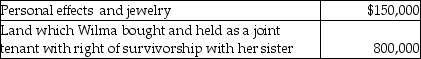

Following are the fair market values of Wilma's assets at her date of death:  The executor of Wilma's estate did not elect the alternate valuation date.The amount includible in Wilma's gross estate is

The executor of Wilma's estate did not elect the alternate valuation date.The amount includible in Wilma's gross estate is

A) $150,000.

B) $550,000.

C) $800,000.

D) $950,000.

Correct Answer:

Verified

Q24: Four years ago, Roper transferred to his

Q25: Identify which of the following statements is

Q51: Two years ago, Nils transfers a $200,000

Q59: In 2006, Roger gives stock valued at

Q59: Four years ago, David gave land to

Q65: Identify which of the following statements is

Q67: Ted died on May 3. At the

Q72: Identify which of the following statements is

Q73: Which of the following credits is available

Q93: Joe dies late in 2011 and his

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents