The Williams Trust was established six years ago.The trust document allows the trustee to distribute income in its discretion to beneficiaries Carol and Karen for the next 15 years.The trust will then be terminated and the trust assets will be divided equally between Carol and Karen.Capital gains are part of principal.

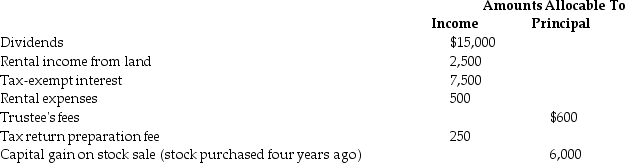

The current year income and expenses of the trust are reported below.

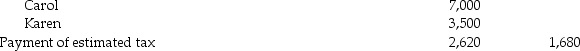

Distribution of net accounting income to:

Distribution of net accounting income to:

Compute (a)distributable net income (DNI),(b)distribution deduction,(c)trust taxable income,and (d)Carol's and Karen's reportable income and its classification.Charge all of the deductible expenses against the rental income.

Compute (a)distributable net income (DNI),(b)distribution deduction,(c)trust taxable income,and (d)Carol's and Karen's reportable income and its classification.Charge all of the deductible expenses against the rental income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: List some common examples of principal and

Q51: Ebony Trust was established two years ago

Q60: Explain the three functions of distributable net

Q67: Explain how to determine the deductible portion

Q71: In the year of termination, a trust

Q78: Describe the tier system for trust beneficiaries.

Q83: A trust document does not mention the

Q87: What is the basis of inherited IRD

Q90: The Tucker Trust was established six years

Q93: A trust reports the following results:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents