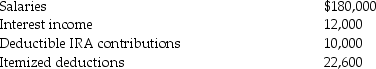

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2013.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

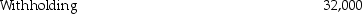

e.What is the amount of their tax due or (refund due)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Eliza Smith's father,Victor,lives with Eliza who is

Q103: Maxine,who is 76 years old and single,is

Q106: Married couples will normally file jointly.Identify a

Q108: In 2013,Sam is single and rents an

Q110: Adam attended college for much of 2013,during

Q112: Hannah is single with no dependents and

Q119: Indicate for each of the following the

Q120: For each of the following independent cases,indicate

Q125: Paige is starting Paige's Poodle Parlor and

Q129: Steve and Jennifer are in the 33%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents