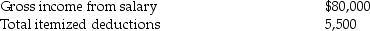

Steve Greene is divorced,age 66,has good eyesight,and lives alone.He claims his son Dylan,who is blind,as his dependent.In 2013 Steve had income and expenses as follows:

Compute Steve's taxable income for 2013.Show all calculations.

Compute Steve's taxable income for 2013.Show all calculations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: Married couples will normally file jointly.Identify a

Q107: A taxpayer can receive innocent spouse relief

Q110: Adam attended college for much of 2013,during

Q117: The following information for 2013 relates to

Q121: Brett,a single taxpayer with no dependents,earns salary

Q125: Paige is starting Paige's Poodle Parlor and

Q125: Paul and Hannah,who are married and file

Q126: Kelsey is a cash-basis,calendar-year taxpayer.Her salary is

Q143: Lester,a widower qualifying as a surviving spouse,has

Q1027: Discuss reasons why a married couple may

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents