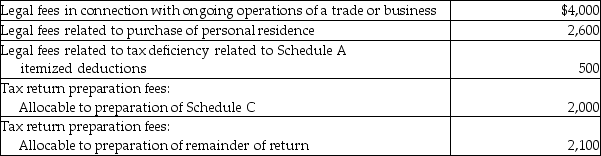

Maria pays the following legal and accounting fees during the year:  What is the total amount of her for AGI deduction for these fees?

What is the total amount of her for AGI deduction for these fees?

A) $4,000

B) $6,000

C) $8,100

D) $11,200

Correct Answer:

Verified

Q12: Deductions for AGI may be located

A)on the

Q15: On Form 1040,deductions for adjusted gross income

Q15: Self-employed individuals may claim,as a deduction for

Q39: Carole owns 75% of Pet Foods,Inc.As CEO,Carole

Q46: Liz,who is single,lives in a single family

Q51: In 2013,Sean,who is single and age 44,received

Q69: Points paid in connection with the purchase

Q86: Generally,Section 267 requires that the deduction of

Q87: The term "principal place of business" includes

Q89: Losses on the sale of property between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents