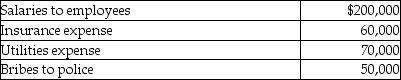

Troy incurs the following expenses in his business (illegal gambling establishment) :  His deductible expenses are

His deductible expenses are

A) $-0-.

B) $200,000.

C) $330,000.

D) $380,000.

Correct Answer:

Verified

Q47: American Healthcare (AH),an insurance company,is trying to

Q48: In March of the current year,Marcus began

Q53: Which of the following factors is important

Q58: During the current year,Ivan begins construction of

Q61: Which of the following is not required

Q67: Which of the following statements is false?

A)A

Q68: Jimmy owns a trucking business.During the current

Q80: In which of the following situations are

Q80: During 2013 and 2014,Danny pays property taxes

Q94: Under the accrual method,recurring liabilities may be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents