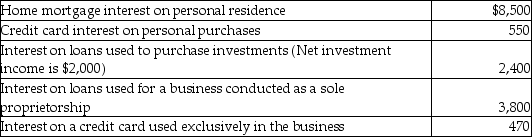

Teri pays the following interest expenses during the year:  What is the amount of interest expense that can be deducted as an itemized deduction?

What is the amount of interest expense that can be deducted as an itemized deduction?

A) $10,500

B) $10,900

C) $14,300

D) $14,700

Correct Answer:

Verified

Q57: Peter is assessed $630 for street improvements

Q61: Dana paid $13,000 of investment interest expense

Q61: Which of the following is deductible as

Q68: On July 31 of the current year,Marjorie

Q71: All of the following statements are true

Q74: In the current year,Julia earns $9,000 in

Q74: Riva borrows $10,000 that she intends to

Q76: Don's records contain the following information: 1.Donated

Q79: Ted pays $2,100 interest on his automobile

Q90: Sacha purchased land in 2010 for $35,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents