Phoebe's AGI for the current year is $120,000.Included in this AGI is $100,000 salary and $20,000 of interest income.In earning the investment income,Phoebe paid investment interest expense of $30,000.She also incurred the following expenditures subject to the 2% of AGI limitation:

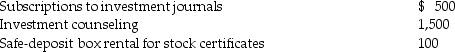

Investment expenses:

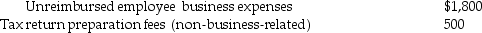

Noninvestment expenses:

Noninvestment expenses:

What is Phoebe's investment interest expense deduction for the year?

What is Phoebe's investment interest expense deduction for the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q95: Tasneem,a single taxpayer has paid the following

Q96: Wang,a licensed architect employed by Skye Architects,incurred

Q102: What is the result if a taxpayer

Q266: Explain under what circumstances meals and lodging

Q280: Explain when the cost of living in

Q335: Explain why interest expense on investments is

Q349: May an individual deduct a charitable contribution

Q352: What is the treatment of charitable contributions

Q357: Explain how tax planning may allow a

Q363: Jill is considering making a donation to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents