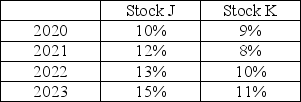

Given the returns of two stocks J and K in the table below over the next 4 years.Find the expected return and standard deviation of holding a portfolio of 40% of stock J and 60% in stock K over the next 4 years:

A) 10.7% and 1.34%

B) 10.6% and 1.79%

C) 10.6% and 1.16%

D) 14.3% and 2.02%

Correct Answer:

Verified

Q65: New investments must be considered in light

Q69: _ is a statistical measure of the

Q70: An efficient portfolio is one that _.

A)

Q74: Given the following probability distribution for assets

Q76: Two assets whose returns move in the

Q78: Two assets whose returns move in the

Q81: Combining assets that are not perfectly positively

Q83: A firm has high sales when the

Q84: The lower the correlation between asset returns,the

Q86: A portfolio combining two assets with less

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents