Use the information for the question(s) below.

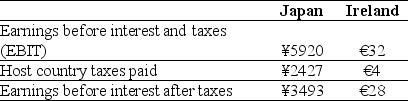

KT Enterprises,a Canadian import-export trading company,is considering its international tax situation.Currently KT's Canadian tax rate is 35%.KT has significant operations in both Japan and Ireland.In Japan,the current exchange rate is ¥118.4/$ and earnings in Japan are taxed at 41%.In Ireland the current exchange rate is $1.27/€ and earnings in Ireland are taxed at 12.5%.KT's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are shown here (in millions) :

-After the Irish taxes are paid,the amount of the earnings before interest and after taxes in dollars from the Ireland operations is closest to:

A) $5.1 million

B) $20.5 million

C) $35.6 million

D) $29.5 million

E) $23.0 million

Correct Answer:

Verified

Q93: The spot exchange rate for Indian rupees

Q94: The spot exchange rate for Indian rupees

Q95: The spot exchange rate for Indian rupees

Q97: What is the amount of Canadian taxes

Q97: All investors in the developed and developing

Q99: The one-year forward exchange rate for the

Q100: The one-year forward exchange rate for the

Q101: What is the best explanation for the

Q102: A Canadian firm acquires a British firm

Q106: Exchange rate risk exists if the firm's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents