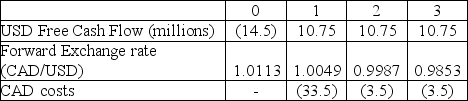

Use the table for the question(s) below.

-You own a Canadian firm that invests in a U.S.project with the cash flows shown in the table above.Given a corporate tax rate of 40% and a WACC of 8.9%,what is the NPV of the investment?

A) $9.3 million CAD

B) $0.1 million CAD

C) -$0.1 million CAD

D) $7.5 million CAD

E) $7.2 million CAD

Correct Answer:

Verified

Q100: The one-year forward exchange rate for the

Q101: What is the best explanation for the

Q102: A Canadian firm acquires a British firm

Q104: Firms must consider the impact of exchange

Q106: Exchange rate risk exists if the firm's

Q106: Use the table for the question(s)below.

Q107: If the cash flows generated by a

Q108: Use the table for the question(s)below.

Q109: A Canadian firm acquires a British firm

Q110: The spot exchange rate for the Mexican

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents