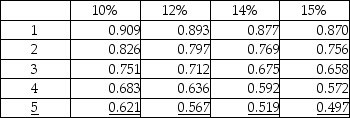

Gamma Company is considering an investment opportunity with the following expected net cash inflows: Year 1, $250,000; Year 2, $350,000; Year 3, $395,000. The company uses a discount rate of 12% and the initial investment is $750,000. The following table is available:

Present Value of $1:  The IRR of the project will be:

The IRR of the project will be:

A) less than 12%.

B) between 12% and 13%.

C) between 14% and 15%.

D) more than 12%.

Correct Answer:

Verified

Q105: The following details are provided by Dopler

Q106: Under conditions of limited resources, when a

Q107: The following details are provided by Dopler

Q108: At the internal rate of return (IRR),

Q109: When comparing several investments with the same

Q111: Following details are provided by Dopler Company.

Q112: Which of the following best describes the

Q113: Which of the following best describes the

Q114: Nobell Company is evaluating an investment of

Q115: Which of the following is the rate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents