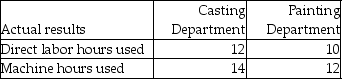

The Sweetheart Corporation uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: cutting and painting. The Cutting Department uses a departmental overhead rate of $12 per machine hour, while the Painting Department uses a departmental overhead rate of $17 per direct labor hour. Job 422 used the following direct labor hours and machine hours in the two departments:

The cost for direct labor is $20 per direct labor hour and the cost of the direct materials used by Job 422 is $800.

The cost for direct labor is $20 per direct labor hour and the cost of the direct materials used by Job 422 is $800.

Required: What was the total cost of Job 422 if the Sweetheart Corporation used the departmental overhead rates to allocate manufacturing overhead?

Correct Answer:

Verified

Q46: Facility-level activities and costs are incurred for

Q47: It is easier to allocate indirect costs

Q48: Batch-level activities and costs are incurred again

Q49: The cost allocation rate for each activity

Q50: The cost of inspecting and packaging each

Q52: The cost to research and develop, design

Q53: Digital Technologies manufactures three types of computers

Q54: OPG Company manufactures display cases to be

Q55: Traditional costing systems are generally more accurate

Q56: Machine set-up would be considered a batch-level

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents