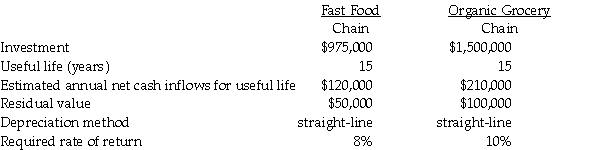

Shaker Investments, a private investment holding company, is searching for a new investment opportunity. Shaker Investments has identified two potential investment opportunities: an upstart fast food chain and a growing organic grocery chain. Information for each investment follows:

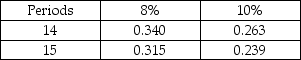

Present Value of $1

Present Value of $1

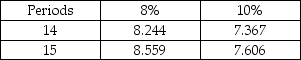

Present Value of Annuity of $1

Present Value of Annuity of $1

Required:

Required:

a. Calculate the net present value of the Fast Food Chain.

b. Calculate the net present value of the Organic Grocery Chain.

c. Using the net present value method, which investment should Shaker select if it can select only one investment?

Correct Answer:

Verified

NPV Organic...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q188: Leonardo Company is deciding whether to automate

Q189: Dandy's Fun Park is evaluating the purchase

Q190: Louise owns a golf course and wants

Q191: Companies often use more than one capital

Q192: Companies may only use one capital budgeting

Q194: Icy Peaks Sports makes snowboards. The company

Q195: The net present value model differs from

Q196: Capital budgeting methods will not work with

Q197: The discounted cash flow methods for capital

Q198: Capital budgeting techniques such as payback method

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents