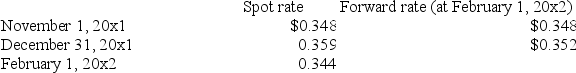

On November 1, 2001 Zamfir Company, a U.S. corporation, purchased minerals from a Russian company for 2,000,000 rubles, payable in 3 months. The relevant exchange rates between the U.S. and Russian currencies are given:  The company's incremental borrowing rate provides a discount rate of 0.975 for three months.

The company's incremental borrowing rate provides a discount rate of 0.975 for three months.

Assume that on November 1, 2001 Zamfir Company enters a forward contract to buy 2,000,000 rubles on February 1, 2002. What is the fair value of the forward contract on December 31, 2001?

A) $8,000

B) $7,800

C) $22,000

D) $8,200

Correct Answer:

Verified

Q16: Which of the following statements is true

Q17: The number of U.S. dollars ($) today

Q18: The central bank of Country X buys

Q19: Why was there very little fluctuation in

Q20: King's Bank, a British company, purchases market

Q22: Amazing Corporation, a U.S. enterprise, sold product

Q23: Amazing Corporation, a U.S. enterprise, sold product

Q24: When two parties from different countries enter

Q25: Amazing Corporation, a U.S. enterprise, sold product

Q26: What is the intrinsic value of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents