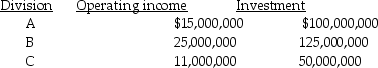

Capital Investments has three divisions.Each division's required rate of return is 15 percent.Planned operating results for next year are:

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.Required:

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.Required:

a.Compute the current ROI for each division.

b.Compute the current residual income for each division.

c.Rank the divisions according to their current ROIs and residual incomes.

d.Determine the effects after adding the new project to each division's ROI and residual income.

e.Which Divisions are pleased with the addition and which ones are unhappy assuming the managers are evaluated on a combination of ROI and residual income? Is a combination of ROI and residual income appropriate for the divisions?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: Jim's Quality Pre-owned Auto Sales Ltd.allows its

Q80: Answer the following question(s)using the information below:

Coldbrook

Q82: Current cost is the cost of purchasing

Q83: The term "investment" used in the calculation

Q85: Chaucer Ltd.has current assets of $450,000 and

Q86: The following table presents information related to

Q88: Gasfield Maintenance Ltd.purchased equipment for $225,000 that

Q89: Provide the missing data for the following

Q90: The economic value added concept has attracted

Q95: Current cost return on investment is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents