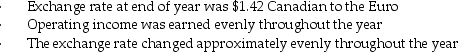

A multinational corporation established a division in Ireland as a subsidiary corporation, with an initial investment in total assets of 13 million €'s, which cost the company $19,240,000 Canadian at the time.The company sent an experienced manager to run the division, and gave her a target of 12% required rate of return, promising a bonus if this was met and/or exceeded.After one year, the subsidiary manager was pleased to report a 15% ROI.You have been able to determine the following data pertaining to the subsidiary:

Required:

Required:

a.Calculate the subsidiary's income in €'s.

b.Calculate the subsidiary's return on investment in Canadian dollars.

c.Calculate the subsidiary's residual income in Canadian dollars.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q130: Current cost is defined as the cost

Q131: The Irnakk Corporation manufactures iPod covers in

Q133: If a company is a multinational company

Q134: A multinational corporation established a division in

Q136: If the exchange rate at the end

Q137: The only criticism of team-based compensation is

Q137: The following data are available for a

Q138: Good performance measures do not change significantly

Q139: It is more cost-efficient for owners to

Q140: Well-designed compensation plans for executives focus on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents