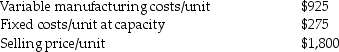

Alpine Ltd.has two divisions.Division A manufactures components that can be sold in the external market place or transferred to Division B for further processing.The following data relate to Division A's component product.  The capacity of the plant is 2,500 units per year.Division B has offered to purchase 350 units from Division A at a price of $1,600/unit, which is the market price of the component.The manager of Division A has refused this offer stating that it would only return a rate of 25.00%, when the divisional target return on sales is 28.00%.The Division A manager also states that additional fixed costs of $195,000 would be required to produce the 350 units.The corporate required rate of return is 18% of assets and the existing asset base in Division A is $2,500,000.Required:

The capacity of the plant is 2,500 units per year.Division B has offered to purchase 350 units from Division A at a price of $1,600/unit, which is the market price of the component.The manager of Division A has refused this offer stating that it would only return a rate of 25.00%, when the divisional target return on sales is 28.00%.The Division A manager also states that additional fixed costs of $195,000 would be required to produce the 350 units.The corporate required rate of return is 18% of assets and the existing asset base in Division A is $2,500,000.Required:

a.How many units must Division A sell in order to achieve its required ROR? What profit margin would be earned at this level of sales?

b.Assume Division A currently sells 2,000 units to the external market and can accept Division B's offer without affecting its external sales.Evaluate the refusal of Division B's offer from the standpoint of the corporation as a whole and from Division A manager's perspective.

c.Assume Division A currently sells 2,000 units to the external market and can accept Division B's offer without affecting its external sales.Calculate Division A's residual income with and without the sale to Division B.

d.What recommendations would you give to the President of Alpine Ltd.with respect to performance evaluation of the divisions?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q156: Which of the following statements is TRUE

Q157: Rozman Construction Supplies Ltd.is preparing the budget

Q158: Wylie Construction Supplies Ltd.is preparing the budget

Q159: The absence of good performance measures restricts

Q160: A control system that focuses on meeting

Q161: Briefly explain each of the four levers

Q162: Managers use _ to create an ongoing

Q163: A control system that attempts to focus

Q164: A part of a control system that

Q166: "Levers of control," in addition to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents