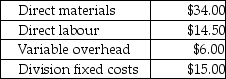

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

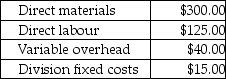

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-If the Assembly Division sells 1,000 air conditioners at a price of $750.00 per air conditioner to customers, what is the company's operating income?

A) $200,500

B) $207,000

C) $194,000

D) $165,750

E) $230,500

Correct Answer:

Verified

Q88: Tech Clothing Ltd.manufactures t-shirts.The Athletic Division sells

Q90: The Brownshoe Company has three specialized divisions.The

Q91: Sandra's Sheet Metal Company has two divisions.The

Q92: Answer the following question(s)using the information below.Cool

Q93: Vancouver Valley Ltd.has two divisions, Computer Services

Q94: Xenon Autocar Company manufactures automobiles. The Fastback

Q94: The Mill Flow Company has two divisions.The

Q95: Sportswear Ltd.manufactures socks.The Athletic Division sells its

Q96: Answer the following question(s)using the information below.Cool

Q97: Answer the following question(s)using the information below.Cool

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents