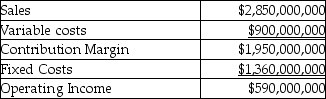

Clark Industries Ltd.manufactures monochromators that are used in a variety of applications.The Monochromator Division (M Division)sells its monochromators both internally and externally.It is operating at 80% of its 250,000 unit capacity and internal sales account for approximately 20% of its current sales volume.Internally the monochromators are transferred into the Aerospace Division (A Division)at a transfer price of $11,250 each.Variable production costs are the same for internal and external sales.The income statement for the M Division is presented below:

The A Division uses one component in the production of its final product that sells for $75,000/unit.Other variable costs in the A Division are 40% of sales.and fixed costs per unit at its current capacity of 40,000 units are $17,250.The Aerospace Division is operating at its full capacity of 40,000 units and is evaluating whether it should invest to increase capacity.The investment would cost $900,000,000 and would have a useful life of 3 years.The equipment could be sold for $800,000 at the end of its useful life.For tax purposes it would be sold on January 1 of year 4.The machine would be used to manufacture a variation of its current product with the same transfer price.This new product would sell for $68,000 per unit.The variable cost ratio will be 45% of the selling price.The additional capacity of the new machine would be 14,000 units.It would qualify for a 30% CCA rate and the company would continue to have assets in the pool.Required:

The A Division uses one component in the production of its final product that sells for $75,000/unit.Other variable costs in the A Division are 40% of sales.and fixed costs per unit at its current capacity of 40,000 units are $17,250.The Aerospace Division is operating at its full capacity of 40,000 units and is evaluating whether it should invest to increase capacity.The investment would cost $900,000,000 and would have a useful life of 3 years.The equipment could be sold for $800,000 at the end of its useful life.For tax purposes it would be sold on January 1 of year 4.The machine would be used to manufacture a variation of its current product with the same transfer price.This new product would sell for $68,000 per unit.The variable cost ratio will be 45% of the selling price.The additional capacity of the new machine would be 14,000 units.It would qualify for a 30% CCA rate and the company would continue to have assets in the pool.Required:

a.Evaluate the current transfer pricing policy from the standpoint of each division manager as well as the company as a whole.

b.Using net present value (NPV)analysis, would the A Division manager want to invest in the new equipment if the required rate of return is 12% and the tax rate is 25%?

c.If the investment is evaluated from a corporate perspective using NPV analysis and the 12% discount rate, does the decision change? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q109: Additional factors that arise in multinational transfer

Q122: It is possible to increase the overall

Q141: What is the role of unused capacity

Q145: A company has a plant in a

Q173: Sales between multi-national corporation subunits are termed

Q174: Sonora Manufacturing Inc.designs and builds off-road vehicles.The

Q176: Hendricks Ltd.of Calgary manufactures and sells computers.The

Q179: Which of the following types of taxes

Q180: The Micro Division of Silicon Computers produces

Q183: What are some of the factors, other

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents