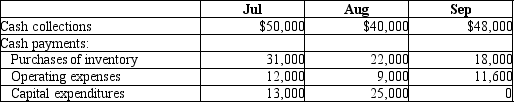

AAA Company is preparing its 3rd quarter budget and provides the following data:  Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

How much cash shortfall will the company have at the end of July, before financing?

A) $2,000

B) $6,500

C) $5,000

D) $1,250

Correct Answer:

Verified

Q43: The cash budget may be used to

Q45: The budgeted "Cash payments for purchases" must

Q60: Dahl Manufacturing is making its operating budget

Q62: California Products Company has the following data

Q63: Berkeley Products has a cash balance of

Q64: Zygot Biotech Company is budgeting for the

Q65: Fast Foods has budgeted sales for June

Q67: Berkeley Products has a cash balance of

Q68: Della Company prepared the following purchases budget:

Q70: Zygot Biotech Company is budgeting for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents