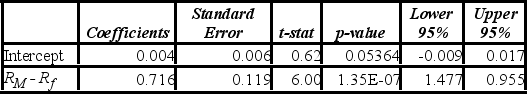

Pfizer Inc. is the world's largest research-based pharmaceutical company. Monthly data for Pfizer's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60). The accompanying table shows the regression results when estimating the Capital Asset Pricing Model (CAPM) model for Pfizer's return.  a. At the 5% significance level, is the beta coefficient less than one? Show the relevant steps of the appropriate hypothesis test.

a. At the 5% significance level, is the beta coefficient less than one? Show the relevant steps of the appropriate hypothesis test.

B) At the 5% significance level, are there abnormal returns? Show the relevant steps of the appropriate hypothesis test.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q109: 113) In a multiple regression based on

Q110: In a simple linear regression based on

Q111: Which of the following is the correct

Q112: Consider the following regression results based on

Q113: Consider the following regression results based on

Q115: Test statistic for the test of linear

Q116: The accompanying table shows the regression results

Q117: Which of the following can be used

Q118: A manager at a local bank analyzed

Q119: An investment analyst wants to examine the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents