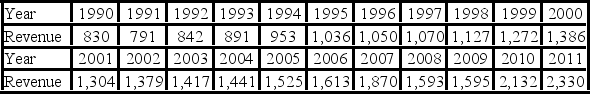

The following table shows the annual revenues (in millions of dollars) of a pharmaceutical company over the period 1990-2011.  The autoregressive models of order 1 and 2, yt = β0 + β1yt - 1 + εt, and yt = β0 + β1yt - 1 + β2yt - 2 + εt, were applied on the time series to make revenue forecasts. The relevant parts of Excel regression outputs are given below.

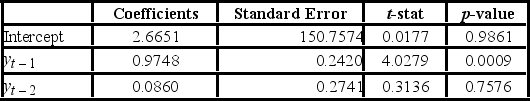

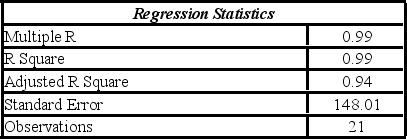

The autoregressive models of order 1 and 2, yt = β0 + β1yt - 1 + εt, and yt = β0 + β1yt - 1 + β2yt - 2 + εt, were applied on the time series to make revenue forecasts. The relevant parts of Excel regression outputs are given below.

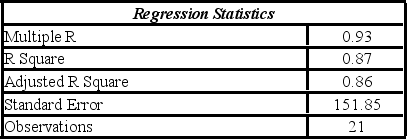

Model AR(1):

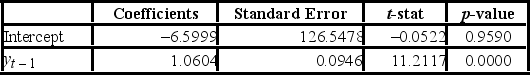

Model AR(2):

Model AR(2):

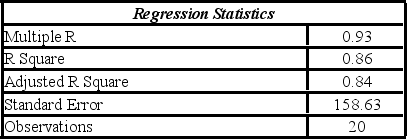

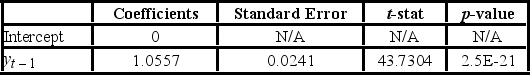

When for AR(1), H0: β0 = 0 is tested against HA: β0 ≠ 0, the p-value of this t test shown the output as 0.9590. This could suggest that the model yt = β1yt-1 + εt might be an alternative to the AR(1) model yt = β0 + β1yt-1 + εt. Partial output for this simplified model is as follows:

When for AR(1), H0: β0 = 0 is tested against HA: β0 ≠ 0, the p-value of this t test shown the output as 0.9590. This could suggest that the model yt = β1yt-1 + εt might be an alternative to the AR(1) model yt = β0 + β1yt-1 + εt. Partial output for this simplified model is as follows:

Find the revenue forecast for 2012 through the use of yt = β1yt-1 + εt.

Find the revenue forecast for 2012 through the use of yt = β1yt-1 + εt.

Correct Answer:

Verified

Q110: Which of the following R functions is

Q111: The model yt = β0 + β1yt

Q112: The following table shows the annual revenues

Q113: The following table shows the annual revenues

Q114: Prices of crude oil have been steadily

Q116: Based on quarterly data collected over the

Q117: Which of the following components does not

Q118: If there are T observations to estimate

Q119: Quarterly sales of a department store for

Q120: Prices of crude oil have been steadily

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents