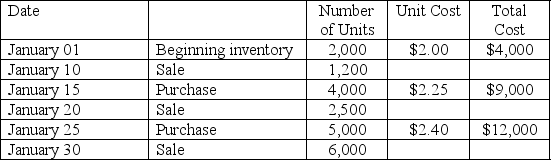

Grand Forks Enterprises sells toy airplanes to retailers such as K-Mart and Wal-Mart.Information about inventory is contained in the table below.The company uses a LIFO perpetual inventory system and sells inventory for $5.00 per unit.  Determine the cost of goods sold for the January 20th sale.

Determine the cost of goods sold for the January 20th sale.

A) $5,425

B) $5,850

C) $5,625

D) $5,725

Correct Answer:

Verified

Q100: Vango,Inc.sells part number 86Z to auto parts

Q101: Inventory information for Great Falls Merchandising,Inc.is provided

Q102: Fargo Engines Incorporated sells part number 45G

Q103: Grand Forks Enterprises sells toy airplanes to

Q104: Philipsburg Corporation sells mugs to fine retailers

Q106: A company would choose to use LIFO

Q107: One difference between U.S.GAAP and IFRS is

Q108: Inventory information for Great Falls Merchandising,Inc.is provided

Q109: Grand Forks Enterprises sells toy airplanes to

Q110: Inventory information for Missoula Merchandising,Inc.is provided below.Sales

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents