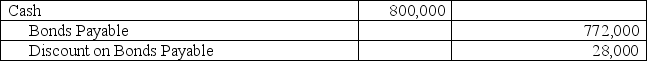

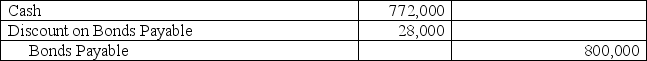

On January 1,2013,Jacob issues $800,000 of 9%,13-year bonds at a price of 96½.Six years later,on January 1,2019,Jacob retires 20% of these bonds by buying them on the open market at 105½.All interest is accounted for and paid through December 31,2018,the day before the purchase.The straight-line method is used to amortize any bond discount or premium.What is the journal entry to record the issuance of the bonds on January 1,2013?

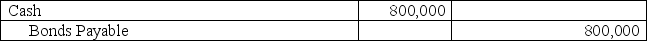

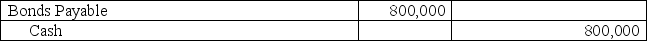

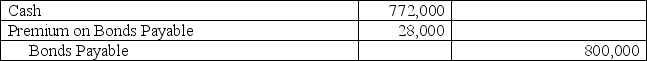

A)

B)

C)

D)

E)

Correct Answer:

Verified

Q77: A company issued 8%,15-year bonds with a

Q78: A company issued 25-year,8% bonds with a

Q79: A company issued seven-year,8% bonds with a

Q80: The Premium on Bonds Payable account is

Q81: On January 1,2013,Jacob issues $600,000 of 11%,15-year

Q83: A company retires its bonds at 105.The

Q84: On April 1,2013,Jared Enterprises issues bonds dated

Q85: On January 1,2013,Jacob issued $600,000 of 11%,15-year

Q86: On October 1,a $30,000,6%,three-year installment note payable

Q87: On January 1,2013,Jacob issues $600,000 of 11%,15-year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents