A company purchased two new delivery vans for a total of $250,000 on January 1,2013.The company paid $40,000 cash and signed a $210,000,three-year,8% note for the remaining balance.The note is to be paid in three annual end-of-year payments of $81,487 each,with the first payment on December 31,2013.Each payment includes interest on the unpaid balance plus principal.

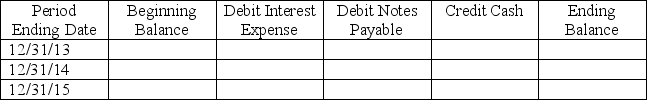

(1) Prepare a note amortization table using the format below:

(2) Prepare the general journal entries to record the purchase of the vans on January 1,2013 and the second annual installment payment on December 31,2014.

(2) Prepare the general journal entries to record the purchase of the vans on January 1,2013 and the second annual installment payment on December 31,2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q150: _ bonds reduce a bondholder's risk by

Q176: A company purchased two new trucks for

Q178: Most mortgage contracts grant the lender the

Q180: The process of systematically reducing a bond

Q182: A company can reserve the right to

Q205: The legal document identifying the rights and

Q211: _bonds have specific assets of the issuing

Q221: _leases are long-term or noncancelable leases by

Q223: The _ concept is the idea that

Q229: The _ method of amortizing a bond

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents