A company estimates that warranty expense will be 4% of sales.The company's sales for the current period are $185,000.The current period's entry to record the warranty expense is:

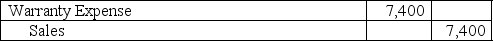

A)

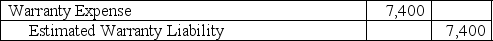

B)

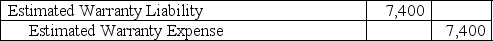

C)

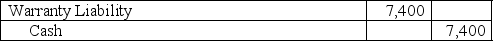

D)

E) No entry is recorded until the items are returned for warranty repairs.

Correct Answer:

Verified

Q53: FUTA taxes are:

A)Social Security taxes.

B)Medicare taxes.

C)Employee income

Q80: Tree Frog Company is organized as a

Q81: An estimated liability:

A) Is an unknown liability

Q82: The annual federal unemployment tax return is:

A)Form

Q84: The FICA tax for Social Security is

Q84: The deferred income tax liability:

A) Represents income

Q85: Employee vacation benefits:

A) Are estimated liabilities.

B) Are

Q88: Maryland Company offers a bonus plan to

Q88: Employees earn vacation pay at the rate

Q90: A company sells leaf blowers for $170

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents