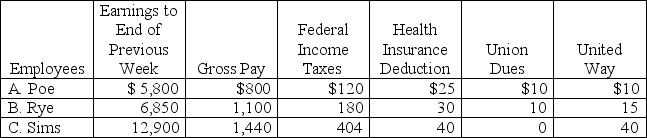

The payroll records of a company provided the following data for the currently weekly pay period ended March 7:

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $110,100 (for 2012) and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $110,100 (for 2012) and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Correct Answer:

Verified

Q144: Pastimes Co. offers its employees a bonus

Q170: _ allowances are items that reduce the

Q175: Cooper Company borrows $785,100 cash on November

Q176: If Jefferson Company paid a bonus equal

Q178: Apple Company has three employees:

Q179: A company's employees had the following earnings

Q187: A _ is a written promise to

Q190: Gross pay less all deductions is called

Q205: To compute the amount of tax withheld

Q206: Companies with many employees often use a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents