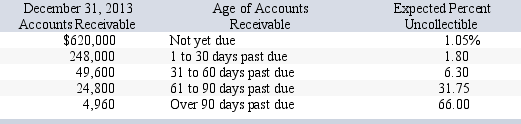

Temper Company has credit sales of $3.10 million for year 2013.Accounts Receivable total $947,360 and the company estimates that 2% of accounts receivable will remain uncollectible.Historically,.9% of sales have been uncollectible.On December 31,2013,the company's Allowance for Doubtful Accounts has an unadjusted debit balance of $2,575.Temper prepared a schedule of its December 31,2013,accounts receivable by age.Based on past experience,it estimates the percent of receivables in each age category that will become uncollectible.This information is summarized here:  Assuming the company uses the percent of accounts receivable method,what is the amount that Temper will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

Assuming the company uses the percent of accounts receivable method,what is the amount that Temper will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

A) $18,947.20

B) $16,372.20

C) $23,024.40

D) $27,900.00

E) $21,522.20

Correct Answer:

Verified

Q82: The amount due on the date of

Q83: Temper Company has credit sales of $3.10

Q85: A company used the percent of sales

Q86: Wallah Company agreed to accept $5,000 in

Q88: A method of estimating bad debts expense

Q89: When the maker of a note honors

Q89: Teller,a calendar year company,purchased merchandise from TechCom

Q90: Paoli Pizza bought $5,000 worth of merchandise

Q91: An accounting procedure that (1) estimates and

Q98: Failure by a promissory note's maker to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents