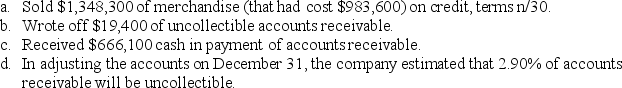

Vine Company began operations on January 1,2013.During its first year,the company completed a number of transactions involving sales on credit,accounts receivable collections,and bad debts.These transactions are summarized as follows:  What is the amount required for the adjusting journal entry to record bad debt expense?

What is the amount required for the adjusting journal entry to record bad debt expense?

A) $18,644.90

B) $38,621.20

C) $19,783.80

D) $19,221.20

E) $19,400.20

Correct Answer:

Verified

Q103: The following information is from the annual

Q104: The following information is from the annual

Q105: On November 15,2013,Betty Corporation accepted a note

Q106: Frontline Company holds a $1,000,12%,90-day note of

Q107: Gamer Inc.determines that it cannot collect $60

Q109: On August 1,2013,Ace Corporation accepted a note

Q110: Describe how accounts receivable arise and how

Q111: Chiller Company has credit sales of $5.60

Q112: Broadway Inc.uses the direct write-off method.Previously,the company

Q113: On November 15,2013,Betty Corporation accepted a note

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents