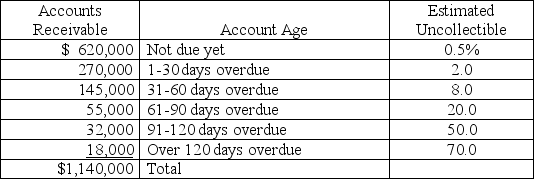

A company uses the aging of accounts receivable method to estimate its bad debts expense.On December 31 of the current year,an aging analysis of accounts receivable revealed the following:

Required:

Required:

a.Calculate the amount of the allowance for doubtful accounts that should be reported on the current year-end balance sheet.

b.Calculate the amount of the bad debts expense that should be reported on the current year's income statement,assuming that the balance of the allowance for doubtful accounts on January 1 of the current year was $44,000 and that accounts receivable written off during the current year totaled $49,200.

c.Prepare the adjusting journal entry to record bad debts expense on December 31 of the current year.

d.Show how accounts receivable will appear on the current year-end balance sheet as of December 31.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: Each December 31, Davis Company ages its

Q149: Corona Company has credit sales of $4.60

Q150: Prepare general journal entries for the following

Q151: Prepare the adjusting journal entry to record

Q152: A company that uses the allowance method

Q155: Prepare general journal entries for the following

Q156: The following information is from the annual

Q157: Welles Company uses the direct write-off method

Q158: A company has the following unadjusted account

Q159: The _ methods use balance sheet relationships

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents