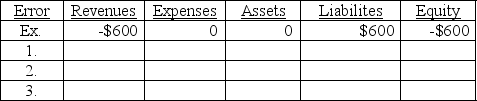

Given the table below, indicate the impact of the following errors made during the adjusting entry process. Use a "+" followed by the amount for overstatements, a "-" followed by the amount for understatements and a "0" for no effect. The first one is done as an example.

Ex. Failed to recognize that $600 of unearned revenues, which were previously recorded as liabilities, had been earned by year-end.

1. Failed to accrue salaries expense of $1,200.

2. Forgot to record $2,700 of depreciation on office equipment.

3. Failed to accrue $300 of interest on a note receivable.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q151: Describe a work sheet and explain why

Q191: July 31,2013,the end of the quarter is

Q192: Calculate the current ratio in each of

Q193: Western Company had $500 of store supplies

Q194: Listed below are a number of accounts.Use

Q195: The calendar year-end adjusted trial balance for

Q197: During its first year of operations,Able Co.purchased

Q198: Prepare an income statement from the adjusted

Q199: Day Co.leases an office to a tenant

Q200: During the current year ended December 31,clients

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents